Welcome to the official Q&A post for the Ecosystem Mapping Survey! It will be regularly updated to ensure clarity and transparency for all community members.

Question: Where is it possible to look up the Public Buyers Community / Innovation Procurement Hubs Community ID?

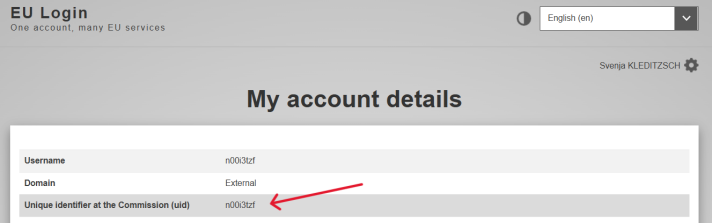

Response: To access your identification number, please follow these three steps:

-

Go to the EU Login page and sign in to your account. Access your account details by clicking your name in the top right corner and selecting "My Account".

-

Next, navigate to "My Account Details”.

-

Lastly, locate and copy the "Unique Identifier at the Commission (UID)” number.

Question: Is it possible to select more than a primary sector?

Response: Yes. The survey is designed to allow selection of multiple sectors to reflect the cross-cutting nature of many innovation procurement activities. You can indicate all the sectors your organisation actively targets.

Question: Could you please clarify the difference between a competence centre and an Innovation Procurement Hub?

Response: Innovation Procurement Hubs are operational actors. They are typically public entities (or consortia) that organise and implement actual innovation procurement activities, such as launching innovation challenges or PPI/PCP procedures. They often serve as launching customers or coordinators of innovation uptake.

Competence Centres, on the other hand, are support and advisory entities. They focus on capacity-building, guidance, and training, helping public buyers understand and implement innovation procurement. They typically do not directly run procurement challenges themselves.

If you recognise your organisation as performing both roles, try to have representatives of each function provide the relevant input with separate responses. If that is not feasible, choose the role most directly linked to your innovation procurement activities and fill in the survey from the perspective of that role.

Question: As a scale-up of wearable robotics, which category would you recommend to allocate us for filling out the survey?

Response: If your organisation focuses on wearable robotics, especially for rehabilitation, assistive movement, or health monitoring, the most relevant sectors to select in the survey would be:

- Healthcare & Medical Innovation under Health & Well-being (e.g., med-tech, digital health, AI in healthcare)

- Optionally, if your solutions also serve users with disabilities or the elderly, you can add Social Care & Inclusion

- If your technologies are aimed at workforce augmentation or industrial applications, also consider:

- Advanced Manufacturing & Robotics under Manufacturing & Industry 4.0

- Workforce Upskilling & Reskilling under Education & Skills Development, if relevant

You can select multiple sectors that reflect your activities. The survey is designed to capture the cross-sectoral nature of many innovative solutions, including wearable robotics.

If none of the above sectors feels like a right fit for your focus, please consider choosing “Other” and adding the most relevant description.

Please note that this survey is intended for demand-side actors only (e.g., public buyers and organisations focused on the procurement side), not for suppliers.

Question: Does the 'Public Demand Drivers' category apply to policymakers who shape policy and establish systems, but are not directly involved in procuring innovation?

Response: Yes, it does. Policymakers who shape frameworks or systems related to innovation procurement can be considered Public Demand Drivers if their role directly affects how innovation procurement is initiated or structured.

However, if their work focuses on enabling or complementary aspects that do not directly shape procurement activities (e.g., Funding policies, tech strategies, financial controls), they may be more appropriately categorised as either an Ecosystem Enabler or part of the Supporting Ecosystem, depending on whether their role involves coordination, regulation, or indirect support.

Question: What exactly qualifies as “local activity” in the survey – and how is it different from “regional”?

Response: In the context of the survey, "local activity" refers to operations focused on a specific city, municipality, or small geographic area. This typically means initiatives serving urban or rural areas, often with close proximity to the stakeholders involved. In contrast, "regional activity" implies a broader geographic scope—usually covering multiple municipalities or a larger administrative region (like a province, county, or regional authority). If your hub serves multiple cities or is coordinated at a regional governance level, "regional" would be the more accurate choice.

Question: If an organisation focuses primarily on supporting SMEs and startups, which category should we select in the survey?

Response: The categorisation in the survey (e.g., type of entity, geographical scope, or sectoral focus) does not depend on whether an organisation targets any specific supply-side segment (e.g., SMEs, startups, large companies).

The programme is designed to support any public sector organisation seeking to improve its innovation procurement practices, frameworks, and effectiveness — with the broader goal of creating a level playing field for all suppliers, including SMEs and startups.

Question: Can non-EEA countries participate in the programme, and if so, how can they contribute to best practice sharing?

Response: Yes, organisations from non-EEA countries can participate in the programme’s Community of Practice (CoP) and engage in best practice sharing, provided they meet the following conditions:

- They are demand-side actors (e.g., public authorities, agencies, or entities involved in shaping or supporting innovation procurement)

- They do not act as suppliers or participate in public procurement as members of supplier consortia

However, there are two limitations to their participation:

- Non-EEA organisations are not eligible for the programme’s support offers, such as direct consultancy services, peer exchange visits, or other advisory and support services targeted to specific beneficiaries

- Their access to specific CoP resources or events may be restricted where confidentiality of EEA Member States must be protected. In such cases, we may restrict the access of these organisations to specific CoP resources or events, or – if needed – we may rescind their membership at any time this is deemed necessary to protect the confidentiality of Member States’ organisations. In such a case, the affected parties will receive a prior notification informing them about the relevant action taken and the effective date. We will carefully consider all options and resolutions available before taking any such action.

These limitations notwithstanding, non-EEA demand-side actors are welcome to contribute insights and join community-level learning activities. Their participation helps enrich the collective knowledge base of the programme.

Question: When will the results of the Ecosystem Mapping Survey be available?

Response: We are currently analysing the responses to the Ecosystem Mapping Survey. An interim update of the results will be shared during a virtual workshop scheduled for July 2025, giving the community an early insight into key trends and findings. The final results, along with a more detailed analysis, will be officially presented during a webinar planned for October 2025. We will share more information on both events shortly, and we warmly encourage everyone to participate!

Details

- Sector

- View

- Public

- Community

- Innovation Procurement Hubs (IPH)

- Publication date

- Submitted by

- European commission

- No